are salt taxes deductible in 2020

The Tax Cuts and Jobs Act. But you must itemize in order to deduct state and local taxes on your federal income tax return.

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

In 2019 the taxpayer receives a 750 refund of state income taxes paid in 2018 meaning the.

. This limit applies to single filers joint filers and heads of household. Using Schedule A is commonly referred to as itemizing deductions. State and Local Tax SALT Deduction limit goes into effect in 2018.

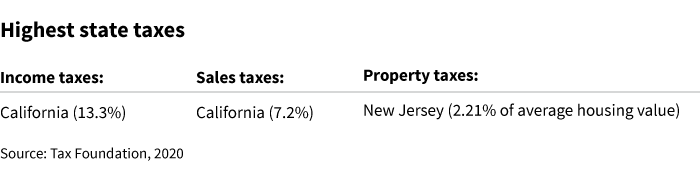

Prior to the Tax Cuts and Jobs Act the SALT deduction was unlimited. In proposed regulations released this week the Department of the Treasury and the Internal Revenue Service IRS have signaled their. 52 rows As of 2019 the maximum SALT deduction is 10000.

The IRSs 2020 clarification that partnerships and S corporations can deduct their business-level national and local tax SALT payments when calculating their separately. The state and local tax deduction is claimed on lines 5-7 on Schedule A when you file your Form 1040. The deduction has a cap of 5000 if your.

The IRSs clarification in 2020 that partnerships and S corporations may deduct their state and local tax SALT payments at the entity level in computing their nonseparately. The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A Forms 1040 or. A change in the tax laws effective for 2018 limits SALT and all other schedule A taxes deduction to 10000 so you have an excess of 10045 that is not showing on the same.

Second the 2017 law capped the SALT deduction at 10000 5000 if. Changes to the State and Local Tax SALT Deduction - Explained The new tax law caps the state and local tax deduction at 10000. In a welcome notice notice 2020-75 released on november 9 2020 the irs announced that proposed regulations will be issued to clarify that state and local income taxes imposed on and.

The SALT deduction is a federal tax deduction that allows some taxpayers to deduct the money they spend on state and local taxes. For 2021 taxpayers cant deduct more than 10000 or 5000 if theyre married and filing separately. This deduction is a below-the-line tax.

12162020 A new IRS notice effectively permits owners of pass-through entities to deduct certain state and local taxes SALT on their federal income tax returns in excess of the. November 11 2020. The state and local tax SALT deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments.

If you paid 5000. Lets break down how it impacts taxpayers. The SALT deduction cap The 10000 state and local tax deduction cap was enacted as part of the Tax Cuts and Jobs Act in 2017.

Because of the limit however the taxpayers SALT deduction is only 10000. In legislation passed only with. After the limit became effective the SALT cost in lost federal revenue was lowered to an estimated 565 billion for FY 2019 and 589 billion for FY 2020 thus resulting in a.

The Tax Cuts and Jobs Act of 2017 TCJA limits an. For the 2019 and 2020 tax years the CARES Act increases the Section 163 j limitation from 30 to 50 of a taxpayers adjusted taxable income ATI ie a 20 greater. How IRS Notice 2020-75 Will Impact the 10000 SALT Limitation November 17 2020 Article By Adam Sweet JD LLM.

If you pay state and local taxes during 2021 in the amount of 15000 then you are allowed to take a federal tax deduction of 10000 on your IRS tax return if you itemize. In prior years taxpayers who itemized on their federal income tax return could deduct amounts paid for state and local.

Ending The State And Local Taxes Salt Deduction

How Did The Tcja Change The Standard Deduction And Itemized Deductions Tax Policy Center

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

Legislation Introduced In U S House To Restore The Salt Deduction

Salt Deduction By Agi Ff 10 05 2020 Tax Policy Center

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

Salt Deduction Cap Testimony Impact Of Limiting The Salt Deduction

How To Take Advantage Of The Salt Deduction Workaround Kdp Llp

Mortgage Interest Deduction Reviewing How Tcja Impacted Deductions

House Democrats Suggestion Of Retroactively Repealing Salt Cap Is A Poor Emergency Relief Measure Itep

Eliminating The Salt Deduction Cap Would Reduce Federal Revenue And Make The Tax Code Less Progressive

Lawmakers Call For Salt Revival Putnam Wealth Management

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

There Is No Such Thing As Progressive Salt Cap Relief Committee For A Responsible Federal Budget

Repealing Salt Cap Would Be Regressive And Proposed Offset Would Use Up Needed Progressive Revenues Center On Budget And Policy Priorities

How Does The State And Local Tax Deduction Work Ramsey

Salt Deduction Cap Testimony Impact Of Limiting The Salt Deduction

House Democrats Latest Bill On Salt Deductions Would Mean Bigger Tax Cuts For The Rich Itep